|

|

Recent Articles

-

Procter & Gamble Maintains Outlook for Fiscal 2025

Procter & Gamble Maintains Outlook for Fiscal 2025

Oct 21, 2024

-

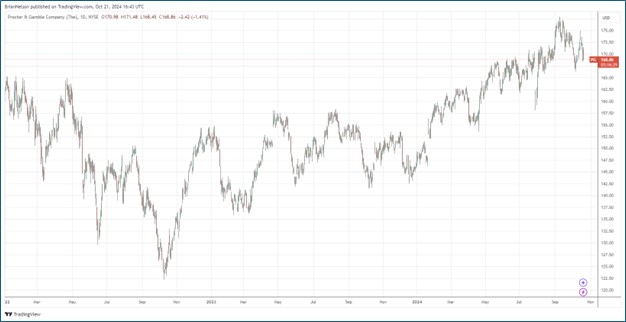

Image: P&G maintained its outlook for fiscal 2025, as shares flirt with all-time highs.

For fiscal 2025, P&G expects adjusted free cash flow productivity to be 90% and to pay roughly $10 billion in dividends while buying back $6-$7 billion in shares. P&G’s quarterly update revealed some top-line pressure and expectations for higher commodity prices, but the company maintained its all-in sales guidance, organic growth guidance, diluted net earnings per share growth guidance, and core earnings per share guidance for fiscal 2025. Shares of P&G yield 2.4% at the time of this writing.

-

Netflix Continues to Deliver on Content and Engagement, Free Cash Flow Robust

Netflix Continues to Deliver on Content and Engagement, Free Cash Flow Robust

Oct 19, 2024

-

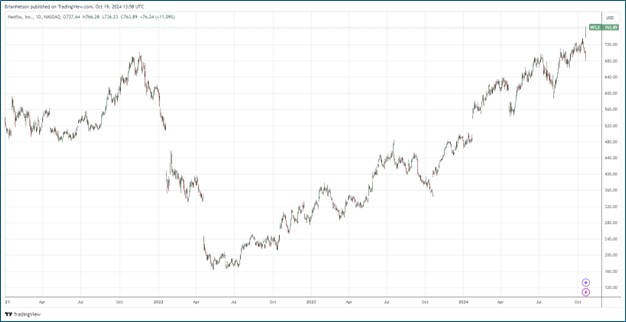

Image: Netflix’s shares are trading at all-time highs.

We liked Netflix’s revenue and operating income improvement in the third quarter, as well as its outlook for the fourth quarter of 2024 and 2025. Netflix is delivering with respect to content and customer engagement, and we like the fact that the firm continues to generate strong free cash flow. Netflix continues to build its advertising business, with ads membership up 35% on a sequential basis. Looking to the fourth quarter, Netflix has a nice slate of content, including Squid Game S2, the Jake Paul/Mike Tyson fight, and two NFL games on Christmas day, which Netflix expects to drive paid net additions higher in the quarter than in its most recently reported third quarter. The high end of our fair value estimate range for Netflix is $867 per share.

-

Dividend Increases/Decreases for the Week of October 18

Dividend Increases/Decreases for the Week of October 18

Oct 18, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Kinder Morgan’s Dividend Is Much Healthier These Days

Kinder Morgan’s Dividend Is Much Healthier These Days

Oct 17, 2024

-

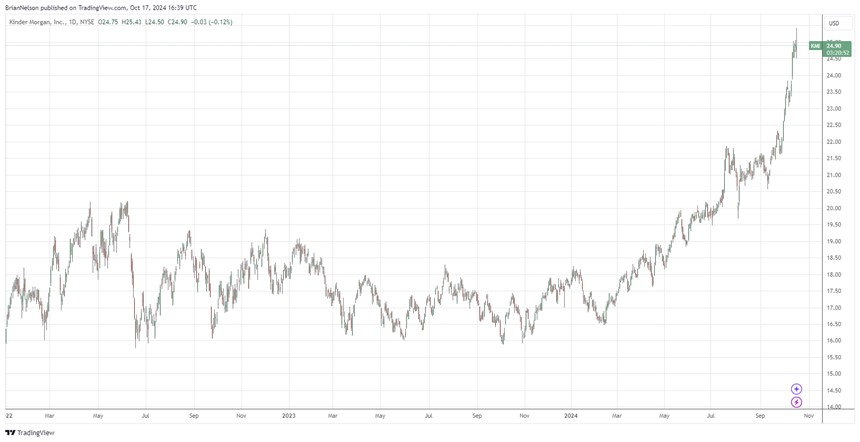

Image: Kinder Morgan’s shares have done quite well thanks to improved free cash flow performance.

Year-to-date Kinder Morgan's free cash flow, as measured by cash flow from operations less all capital spending, totaled $2.27 billion, higher than the $1.92 billion it paid in cash dividends during the same time period. Years ago, Kinder Morgan’s capital spending and cash dividends paid were significantly higher than cash flow from operations, necessitating a dividend cut. Things are much different these days, as Kinder Morgan’s free cash flow covered cash dividends paid by $353 million during the first nine months of the year. Though the firm retains a large net debt position, Kinder Morgan’s dividend is much healthier than it was years ago. Shares yield 4.6% at the time of this writing.

|