|

|

Recent Articles

-

Honeywell Adjusts Full Year 2024 Guidance

Honeywell Adjusts Full Year 2024 Guidance

Oct 24, 2024

-

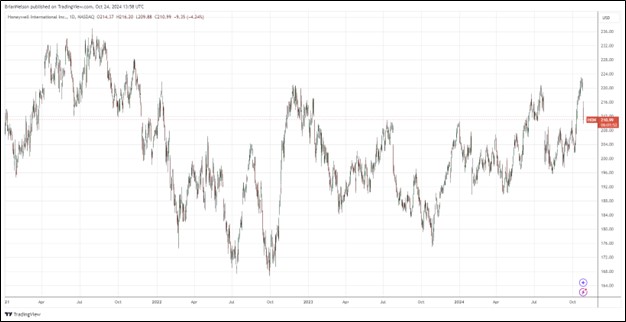

Image: Honeywell’s shares have traded sideways the past couple years.

Honeywell has a lot of moving parts these days. The company closed its $1.9 billion acquisition of CAES Systems and $1.8 billion acquisition of Air Products’ LNG business, while it plans to spin off its Advanced Materials business and exit its PPE business. We’re big fans of Honeywell’s aerospace division, which recorded its ninth consecutive quarter of double-digit organic growth thanks to strong commercial original equipment and solid growth in commercial aftermarket. Though the firm reduced its revenue and free cash flow outlook for 2024, we like the long-term story at Honeywell, and the company remains a core holding in the Dividend Growth Newsletter portfolio. Our fair value estimate stands at $216 per share.

-

Clean Energy Idea GE Vernova Reaffirms 2024 Guidance

Clean Energy Idea GE Vernova Reaffirms 2024 Guidance

Oct 24, 2024

-

Image: GE Vernova shares have powered higher as of late.

GE Vernova reaffirmed its 2024 financial guidance, with revenue now trending towards the higher end of the range of $34-$35 billion, adjusted EBITDA margin of 5%-7%, and free cash flow of $1.3-$1.7 billion, also now trending towards the higher end of the free cash flow range. In Power, the company expects mid-single-digit organic revenue growth and 150-200 basis points of organic segment EBITDA margin expansion. In Wind, the company expects flat organic growth, and it expects material segment EBITDA improvement. In Electrification, the company now expects high teens organic revenue growth, up from prior guidance of mid-to-high teens.

-

Tesla’s Margins, Free Cash Flow Swell in Third Quarter

Tesla’s Margins, Free Cash Flow Swell in Third Quarter

Oct 23, 2024

-

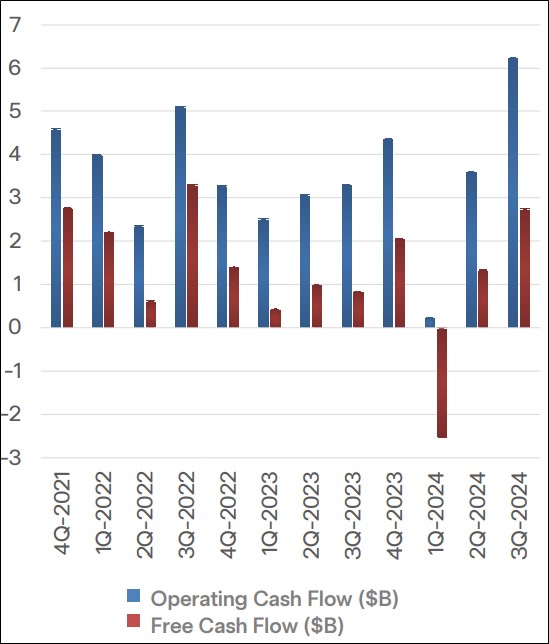

Image: Tesla has returned to a free cash flow rich entity.

Tesla reported solid third quarter results that showed a business that is getting back on track. Not only did production and deliveries increase nicely on a year-over-year basis, but the firm’s margin improvement is a sight to see and comes in the wake of lowered vehicle selling prices. Tesla also showcased its cash generation capacity in the quarter, with free cash flow more than tripling. We like Tesla’s net-cash-rich balance sheet, its free cash flow generation, and its ability to drive growth, but we fall short of including shares in any newsletter portfolio.

-

NextEra Energy Reaffirms Outlook

NextEra Energy Reaffirms Outlook

Oct 23, 2024

-

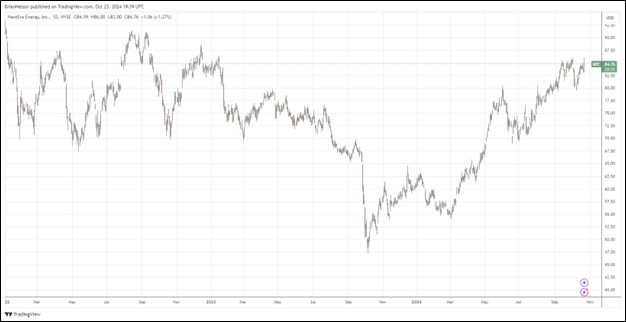

Image: NextEra Energy’s shares have bounced back nicely from their October 2023 lows.

NextEra Energy reaffirmed its outlook, which we like quite a bit. This year, NextEra Energy continues to expect adjusted earnings per share in the range of $3.23-$3.43. For 2025, 2026, and 2027, the company expects adjusted earnings per share in the ranges of $3.45-$3.70, $3.63-$4.00 and $3.85-$4.32, respectively. NextEra Energy also continues to expect to grow its dividends per share at roughly a 10% rate per year through at least 2026, off a 2024 base. We like NextEra Energy as a core holding in the ESG Newsletter portfolio.

|