|

|

Recent Articles

-

Adobe Issues Cautious Fiscal 2025 Guidance

Adobe Issues Cautious Fiscal 2025 Guidance

Dec 12, 2024

-

Image Source: Adobe.

Looking to fiscal 2025, Adobe expects total revenue in the range of $23.30-$23.55 billion, below the $23.8 billion consensus estimate. Digital Media segment revenue is targeted at $17.25-$17.4 billion, with ending ARR growth of 11% year-over-year, while Digital Experience segment revenue is expected to be between $5.8-$5.9 billion. Non-GAAP earnings per share is expected in the range of $20.20-$20.50 for the year, the midpoint below the consensus estimate of $20.52. Adobe ended the quarter with $7.9 billion in cash and short-term investments, while debt totaled $5.6 billion, good for a nice net cash position. We like Adobe, but its cautious outlook for 2025 keeps us on the sidelines.

-

Toll Brothers Ends Strongest Year Ever

Toll Brothers Ends Strongest Year Ever

Dec 11, 2024

-

Image Source: Toll Brothers.

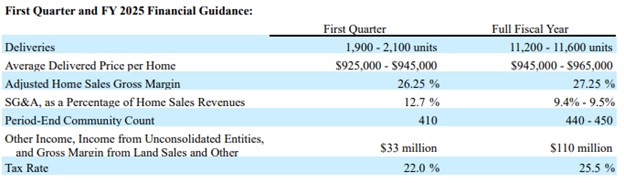

Looking to fiscal 2025, Toll Brothers' deliveries are expected in the range of 11,200-11,600 units with an average delivered price per home of $945,000-$965,000 and adjusted home sales gross margin expected at 27.25%. The company’s pace of deliveries is expected to be strong, but the company’s gross margin isn’t as strong as we would like, facing pressure from last year’s adjusted mark. SG&A, as a percentage of home sales revenue is expected in the range of 9.4%-9.5%, up from last year’s measure of 9.3%. Toll Brothers ended its fiscal fourth quarter with $1.3 billion in cash and cash equivalents and $2.7 billion in loans payable and senior notes. The company continues to return cash to shareholders in the form of buybacks and dividends. Though we don’t include Toll Brothers in any newsletter portfolio, the bellwether’s fiscal fourth quarter report indicates the housing market remains healthy.

-

Oracle’s Remaining Performance Obligations (RPO) Growth Speaks to Accelerated Expansion

Oracle’s Remaining Performance Obligations (RPO) Growth Speaks to Accelerated Expansion

Dec 10, 2024

-

Image Source: Oracle.

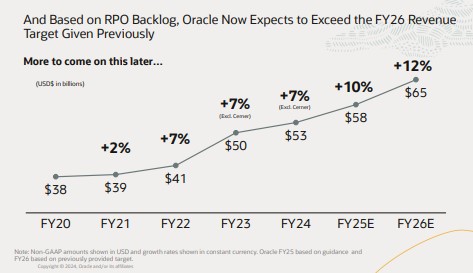

We particularly liked Oracle’s growth in total remaining performance obligations (RPO) in the quarter, which were up 49% in USD and 50% in constant currency year-over-year. During the past twelve months, Oracle’s operating cash flow came in at $20.3 billion, while free cash flow was $9.5 billion. The company ended the quarter with $11.3 billion in cash and marketable securities and $88.6 billion in notes payable and other borrowings. Though Oracle has a hefty net debt position and capital spending is expected to double in fiscal 2025, we still like the company’s cloud opportunity, and it remains a key holding in both the simulated Dividend Growth Newsletter portfolio and simulated ESG Newsletter portfolio.

-

Dollar General Hit By Hurricane-Related Expenses

Dollar General Hit By Hurricane-Related Expenses

Dec 8, 2024

-

Image Source: Valuentum.

Looking to fiscal 2024, Dollar General’s net sales growth is expected in the range of 4.8%-5.1% compared to prior expectations of 4.7%-5.3%. Same-store sales growth for the year is targeted in the range of 1.1%-1.4% compared with prior expectations in the range of 1%-1.6%. Diluted earnings per share for the year is now anticipated in the range of $5.50-$5.90 compared to prior expectations of $5.50-$6.20. For fiscal 2025, Dollar General plans to execute 4,885 real estate projects, including opening roughly 575 new stores in the U.S., up to 15 new stores in Mexico, fully renovating approximately 2,000 stores, remodeling roughly 2,250 stores, and relocating approximately 45 stores. Though its same-store sales growth and store expansion initiatives are noteworthy, Dollar General no longer makes the cut for inclusion in any of the newsletter portfolios.

|