|

|

Recent Articles

-

Nvidia Says “Blackwell Sales Are Off the Charts”

Nvidia Says “Blackwell Sales Are Off the Charts”

Nov 20, 2025

-

Image Source: TradingView.

In the first nine months of fiscal 2026, Nvidia returned $27 billion to shareholders in the form of share buybacks and cash dividends. At the end of the third quarter, Nvidia had $62.2 billion remaining under its share repurchase authorization. Looking to the fiscal fourth quarter, management is targeting revenue to be $65 billion, plus or minus 2% (versus $62 billion consensus), with non-GAAP gross margin of 75%, plus or minus 50 basis points. We think Nvidia is still in the early innings of an AI build cycle, and the firm remains a core idea in the Best Ideas Newsletter portfolio.

-

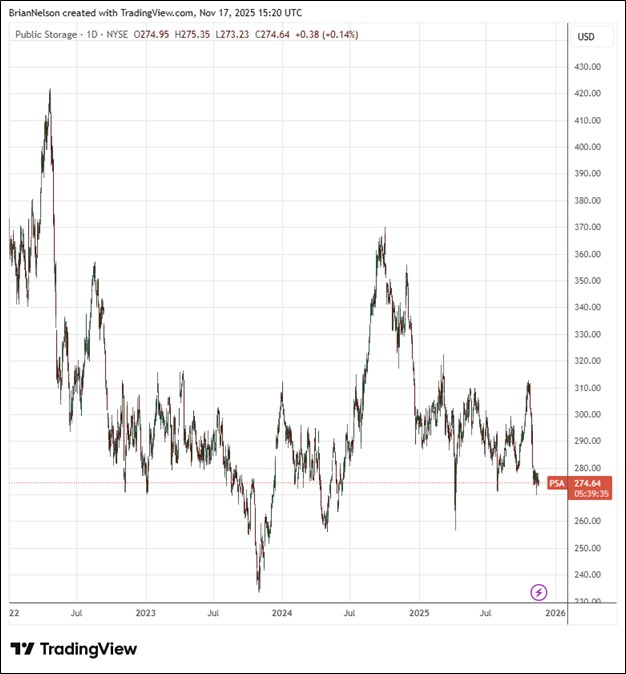

Public Storage Raises Outlook for Second Consecutive Quarter

Public Storage Raises Outlook for Second Consecutive Quarter

Nov 17, 2025

-

Image Source: TradingView.

Looking to 2025, Public Storage's revenue growth is anticipated in the range of -0.3%-0.3%, narrowed from the prior range of -1.3%-0.8%. Expense growth is targeted in the range of 1.8%-2.8%, down from the prior range of 2.3%-3.0%. Net operating income is now expected to decline 1.2%-0.2% versus a range of down 2.6% and up 0.3% previously. Non-same store net operating income is expected in the range of $475-$485 million, up from the range of $465-$475 million. Core FFO per share is now targeted in the range of $16.70-$17.00, up 0.2%-2.0% and the lower end of the guidance range raised from $16.45-$17.00. Public Storage is one of our favorite REITs, with the company yielding 4.4% at the time of this writing.

-

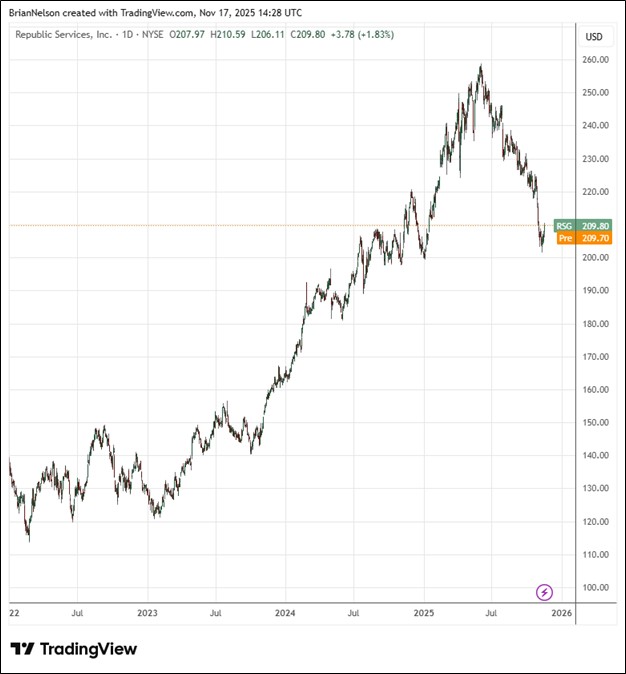

Republic Services’ Pricing Strength Drives Results

Republic Services’ Pricing Strength Drives Results

Nov 17, 2025

-

Image Source: TradingView.

Republic Services continues to price ahead of cost inflation. In the quarter, core price on total revenue increased 5.9%, while revenue growth from average yield on total revenue was 4.0% as volume decreased total revenue by 0.3%. Year-to-date cash flow from operating activities was $3.32 billion, while adjusted free cash flow came in at $2.19 billion. Year-to-date cash returned to shareholders was $1.13 billion, which included $584 of share buybacks and $544 million of dividends paid. Republic ended the quarter with $13.3 billion in total debt and $84 million in cash and cash equivalents. We like Republic Services’ pricing power, and the garbage hauler remains a core holding in the newsletter portfolios.

-

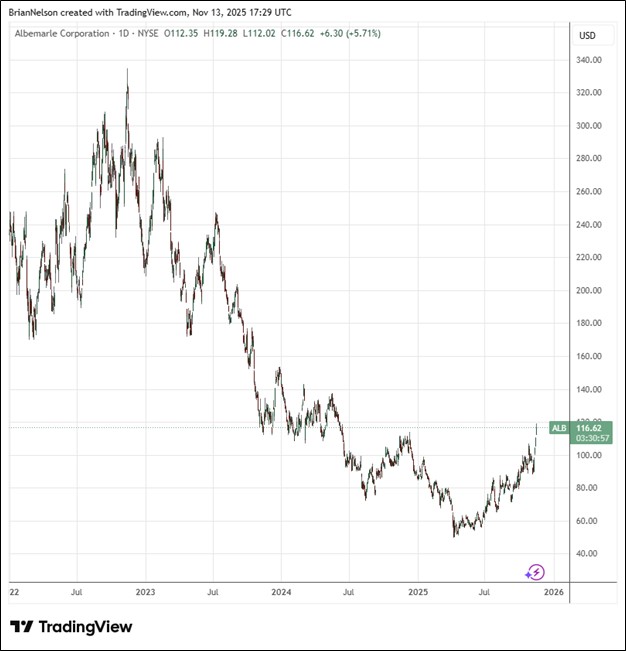

Albemarle Is Getting Back on Track

Albemarle Is Getting Back on Track

Nov 13, 2025

-

Image Source: TradingView.

Albemarle’s third quarter cash from operations of $356 million increased 57% relative to last year’s mark, while on a year-to-date basis, the metric was up 29%, to $894 million, due in part to cost and productivity improvements, cash management actions, and a customer prepayment received in January. Full-year 2025 capital expenditures are targeted at about $600 million, and the firm reiterated it view that it expects to achieve positive free cash flow of $300-$400 million for the full year 2025. Management expects full-year results to be towards the higher end of the previously published $9/kg scenario ranges, or net sales of $5.2 billion and adjusted EBITDA of $1 billion. We think Albemarle is getting back on track, and the company remains an idea in the ESG Newsletter portfolio.

|