|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of February 21

Dividend Increases/Decreases for the Week of February 21

Feb 21, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

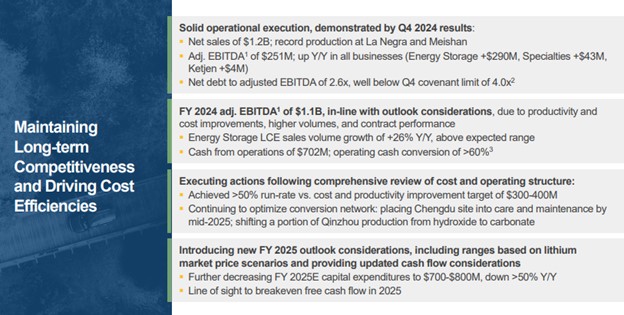

Albemarle Has Line of Sight to Breakeven Free Cash Flow in 2025

Albemarle Has Line of Sight to Breakeven Free Cash Flow in 2025

Feb 19, 2025

-

Image Source: Albemarle.

Albemarle recorded full-year cash flow from operations of $702 million, which represented 60% of adjusted EBITDA, revealing good cash flow conversion. Management plans to further reduce 2025 capital expenditures by $100 million, to the range of $700-$800 million, down more than 50% on a year-over-year basis. Albemarle noted that it has a “line of sight to breakeven free cash flow in 2025,” which should alleviate some pressure on its stock.

-

Republic Services Remains a Cash Cow

Republic Services Remains a Cash Cow

Feb 19, 2025

-

Image Source: Republic Services.

For the full year, Republic’s cash provided by operating activities was $3.94 billion, up 8.8% from last year. Adjusted free cash flow was $2.18 billion, an increase of 10% versus the prior year. The company returned $1.18 billion in cash to shareholders during 2024, consisting of $490 million of share repurchases and $687 million of dividends paid. Looking to 2025, Republic expects revenue in the range of $16.85-$16.95 billion and adjusted EBITDA in the range of $5.275-$5.325 billion. Adjusted diluted earnings per share is targeted in the range of $6.82-$6.90 for the year, while adjusted free cash flow is expected in the range of $2.32-$2.36 billion. We continue to like Republic Services as an idea in the newsletter portfolios.

-

Dividend Increases/Decreases for the Week of February 14

Dividend Increases/Decreases for the Week of February 14

Feb 14, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

|