|

|

Recent Articles

-

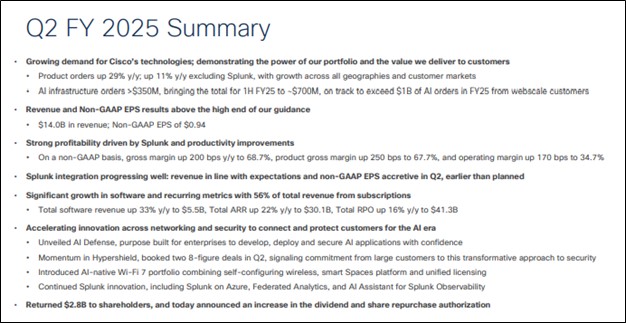

Cisco Ups Fiscal 2025 Guidance Again

Cisco Ups Fiscal 2025 Guidance Again

Feb 13, 2025

-

Image Source: Cisco.

Looking to fiscal third quarter guidance, Cisco's revenue is expected to be between $13.9-$14.1 billion, and non-GAAP earnings per share to be between $0.90-$0.92. For all of fiscal 2025, management expects revenue in the range of $56-$56.5 billion (was $55.3-$56.3 billion) and non-GAAP earnings per share in the range of $3.68-$3.74 (was $3.60-$3.66 per share). We continue to like Cisco as a holding in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. The high end of our fair value estimate range stands at $73 per share.

-

Vertex Pharma Is One of Our Favorite Biotechs

Vertex Pharma Is One of Our Favorite Biotechs

Feb 11, 2025

-

Image: Vertex Pharma has performed quite well since the beginning of 2023.

Looking to 2025, Vertex expects total revenue of $11.75-$12 billion, which includes expectations for continued growth in its cystic fibrosis portfolio, “including the U.S. launch of ALYFTREK, as well as continued uptake of CASGEVY in multiple regions; and early contributions from the launch of JOURNAVX." Cash and total marketable securities as of the end of last year were $11.2 billion, compared to $13.7 billion at the end of 2023 due to the cash consideration paid to acquire Alpine and share buybacks. Vertex had no traditional debt. We continue to like Vertex Pharma as a holding in the Best Ideas Newsletter portfolio.

-

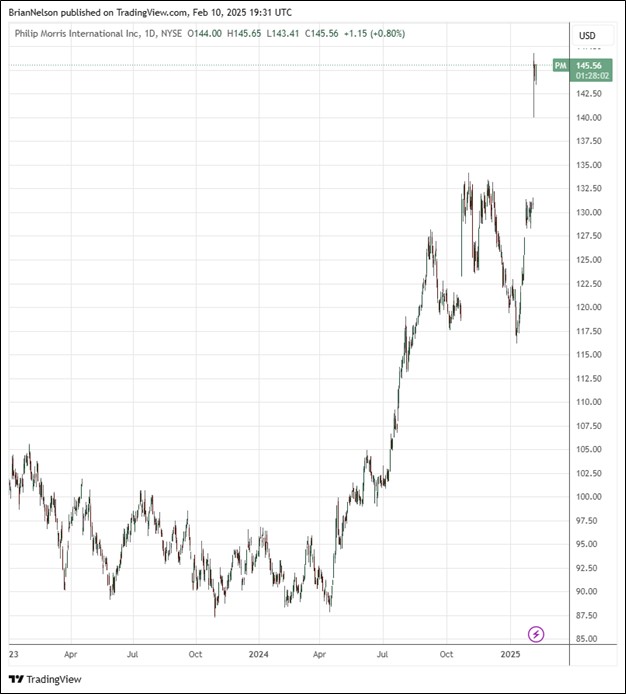

Philip Morris’ Smoke-Free Portfolio Continues to Deliver

Philip Morris’ Smoke-Free Portfolio Continues to Deliver

Feb 10, 2025

-

Image: Philip Morris' stock has performed well of late.

Looking to 2025, Philip Morris’ reported diluted earnings per share is forecast to be in the range of $6.55-$6.68 versus reported diluted earnings per share of $4.52 in 2024. Excluding amortization of intangibles, adjusted diluted earnings per share is targeted in the range of $7.04-$7.17, reflecting 7.2%-9.1% growth versus adjusted diluted earnings per share of $6.57 in 2024. Also excluding adverse currency impacts, management’s 2025 guidance represents a projected increase of 10.5%-12.5%, to the range of $7.26-$7.39, versus adjusted diluted earnings per share of $6.57 in 2024. For 2025, operating cash flow is expected around $11 billion, while capital spending is expected at approximately $1.5 billion, revealing expected free cash flow of $9.5 billion on the year. We continue to like Philip Morris in the High Yield Dividend Newsletter portfolio.

-

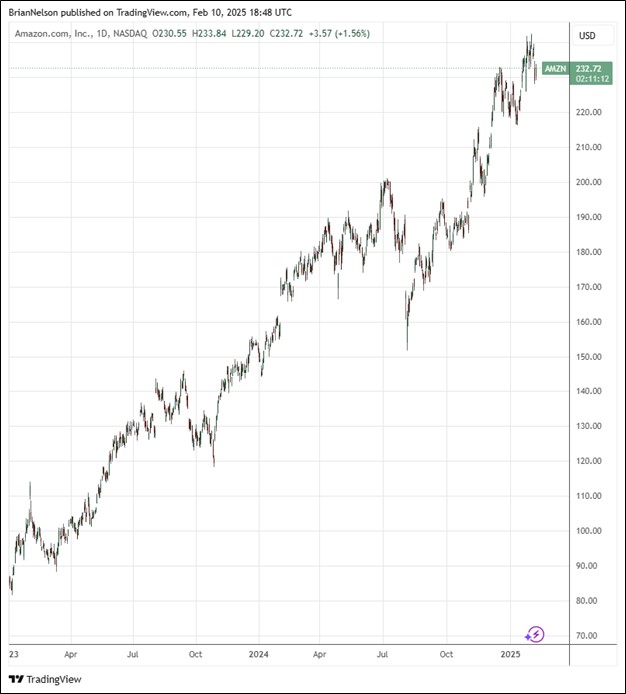

Amazon Expects Elevated Capital Spending in 2025

Amazon Expects Elevated Capital Spending in 2025

Feb 10, 2025

-

Image: Amazon's stock has done quite well in recent months.

Amazon’s operating cash flow increased 36%, to $115.9 billion for the trailing twelve months, while free cash flow for the trailing twelve months was $38.2 billion compared to $36.8 billion for the trailing twelve months ended December 31, 2023. Purchases of propery and equipment were $27.8 billion in the fourth quarter of 2024, up from $14.6 billion in the same quarter last year. Capital spending is expected to be north of $100 billion in 2025. Looking to the first quarter of 2025, Amazon’s net sales are expected to be between $151-$155.5 billion (below the consensus forecast of $158.3 billion), or to grow between 5%-9%, while operating income is expected to be between $14-$18 billion, compared with $15.3 billion in the first quarter of 2024. Cash and marketable securities at the end of the calendar year totaled $101.2 billion, while long-term debt was $52.6 billion. We continue to like Amazon as a holding in the Best Ideas Newsletter portfolio.

|