|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of March 28

Dividend Increases/Decreases for the Week of March 28

Mar 28, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Nike Faces Continued Revenue Declines

Nike Faces Continued Revenue Declines

Mar 22, 2025

-

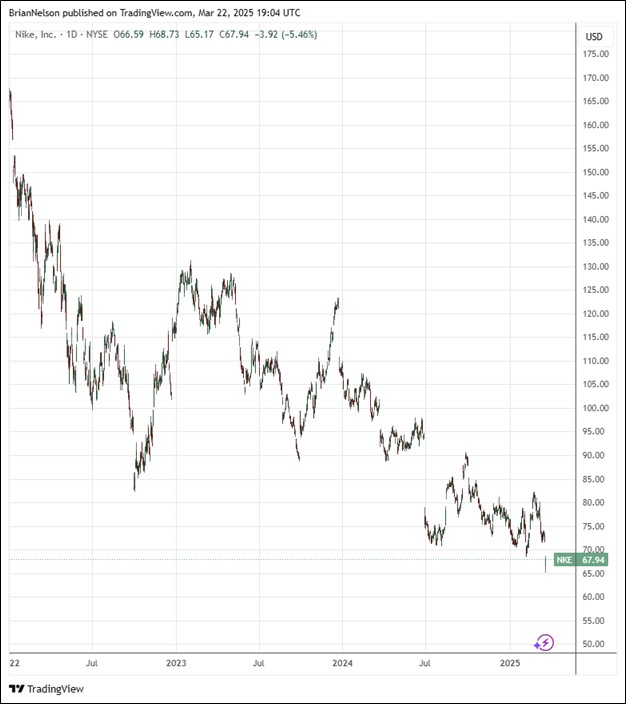

Image: Nike’s shares remain under pressure.

Nike had the following to say about its outlook on the conference call: “Our fourth quarter guidance includes our best assessment of these factors based on the data we have available to us today. We expect Q4 revenues to be down in the mid-teens range, albeit at the low end. This includes several points of unfavorable shipment timing in North America, as well as 2 points of negative impact from foreign exchange headwinds. We expect Q4 gross margins to be down approximately 400 basis points to 500 basis points, including restructuring charges during the same period last year. We have included the estimated impact from newly implemented tariffs on imports from China and Mexico.” Nike continues to be in the early stages of a turnaround. Shares yield 2.4% at the time of this writing.

-

Dividend Increases/Decreases for the Week of March 21

Dividend Increases/Decreases for the Week of March 21

Mar 21, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Realty Income Has Raised Its Dividend 130 Times Since Listing on the NYSE in 1994

Realty Income Has Raised Its Dividend 130 Times Since Listing on the NYSE in 1994

Mar 17, 2025

-

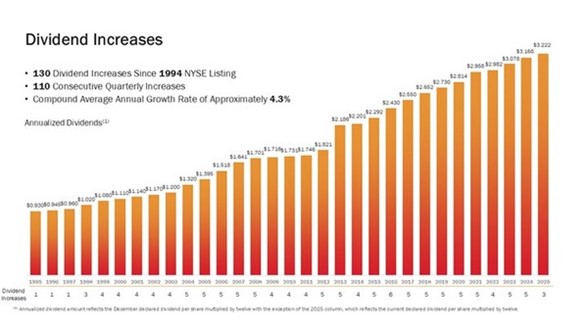

Image Source: Realty Income.

In March 2025, Realty Income announced its 130th dividend increase since it listed on the NYSE in 1994. The annualized dividend amount now stands at $3.222 per share compared to the prior annualized dividend amount of $3.216 per share. Looking to 2025, Realty Income’s net income per share is expected between $1.52-$1.58, AFFO per share is targeted at $4.22-$4.28, while same store rent growth is expected to be approximately 1% on occupancy over 98%. As of December 31, 2024, the REIT had $3.7 billion of liquidity. We like Realty Income but don’t include shares of the REIT in any newsletter portfolio. Shares yield 5.7% at the time of this writing.

|