|

|

Recent Articles

-

Enterprise Products Partners Raises Buyback Program

Enterprise Products Partners Raises Buyback Program

Nov 28, 2025

-

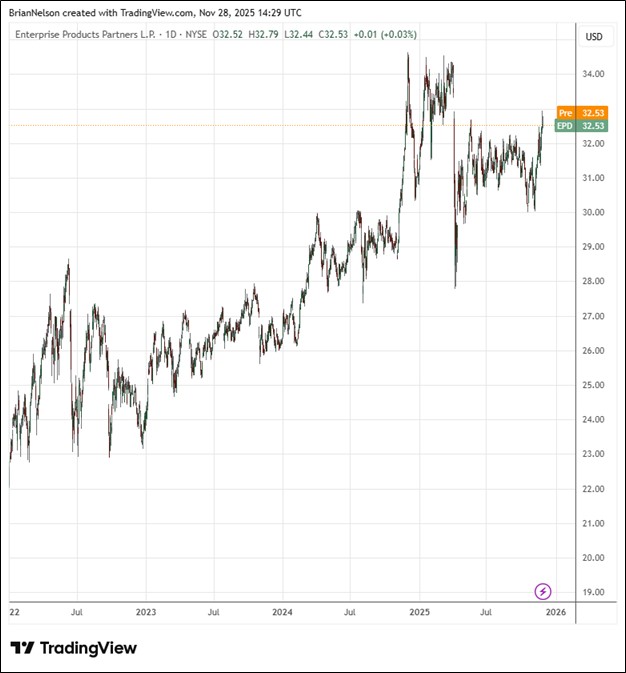

Image Source: TradingView.

Enterprise Products Partners announced that it raised the partnership’s common unit buyback program to $5 billion from $2 billion previously. The remaining available capacity under its new buyback program is now $3.6 billion. Total debt principal outstanding at the end of the quarter was $33.9 billion, with the company having consolidated liquidity of approximately $3.6 billion, comprised of borrowing capacity under its revolving credit facilities and unrestricted cash on hand. Though Enterprise’s third quarter results revealed some pressure on performance, its DCF coverage of the distribution remains solid and we have no qualms with its increased buyback authorization. We continue to like Enterprise Products Partners as an idea in the High Yield Dividend Newsletter portfolio. Units yield 6.7% at the time of this writing.

-

Dick’s Sporting Goods Has Lots of Work to Do Following Its Acquisition of Foot Locker

Dick’s Sporting Goods Has Lots of Work to Do Following Its Acquisition of Foot Locker

Nov 28, 2025

-

Image Source: TradingView.

For the 39 weeks ended November 1, Dick’s Sporting Goods bought back $299 million of shares, while it paid $306 million in dividends. The company ended the quarter with long-term debt and financing lease obligations of $1.9 billion against a cash balance of $821 million. Net inventories were up 51% year-over-year, to $5.64 billion. For the DICK’S Business, net sales are expected to be between $13.95-$14 billion in 2025, with earnings per share in the range of $14.25-$14.55, the $14.40 midpoint slightly below consensus forecast of $14.48 per share. Comparable store sales are targeted to be between 3.5%-4% for the year, while management expects to spend approximately $1 billion in capital expenditures on a net basis. We continue to like Dick’s Sporting Goods as a strong dividend growth idea. Shares yield 2.3% at the time of this writing.

-

Walmart Delivers Another Strong Quarter

Walmart Delivers Another Strong Quarter

Nov 20, 2025

-

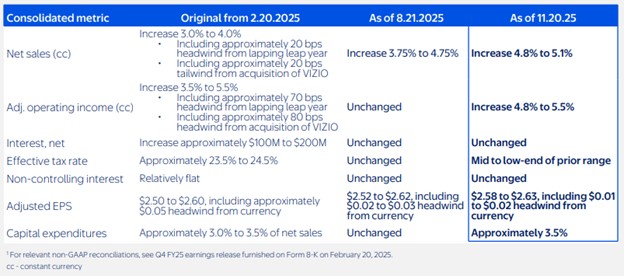

Image Source: Walmart.

Walmart’s operating cash flow came in at $27.5 billion in the third quarter, an increase of $4.5 billion from last year’s tally. Free cash flow was $8.8 billion in the quarter, an increase of $2.6 billion from the same period a year ago. Year-to-date, Walmart repurchased 73.5 million shares for roughly $7 billion. Cash and cash equivalents came in at $10.6 billion, with total debt of $53.1 billion. At the end of the quarter, inventory totaled $65.4 billion, an increase of $2.1 billion or 3.2%. Looking to all of fiscal year 2026, Walmart raised its outlook for growth in net sales to the range of 4.8%-5.1% and adjusted operating income to the range of 4.8%-5.5%, both in constant currency. Adjusted earnings per share is expected to be between $2.58-$2.63, which includes a currency headwind of a penny or two. Shares yield 0.9% at the time of this writing.

-

Nvidia Says “Blackwell Sales Are Off the Charts”

Nvidia Says “Blackwell Sales Are Off the Charts”

Nov 20, 2025

-

Image Source: TradingView.

In the first nine months of fiscal 2026, Nvidia returned $27 billion to shareholders in the form of share buybacks and cash dividends. At the end of the third quarter, Nvidia had $62.2 billion remaining under its share repurchase authorization. Looking to the fiscal fourth quarter, management is targeting revenue to be $65 billion, plus or minus 2% (versus $62 billion consensus), with non-GAAP gross margin of 75%, plus or minus 50 basis points. We think Nvidia is still in the early innings of an AI build cycle, and the firm remains a core idea in the Best Ideas Newsletter portfolio.

|