|

|

Recent Articles

-

Dollar General Raises Guidance Despite Tariff Uncertainty

Dollar General Raises Guidance Despite Tariff Uncertainty

Jun 3, 2025

-

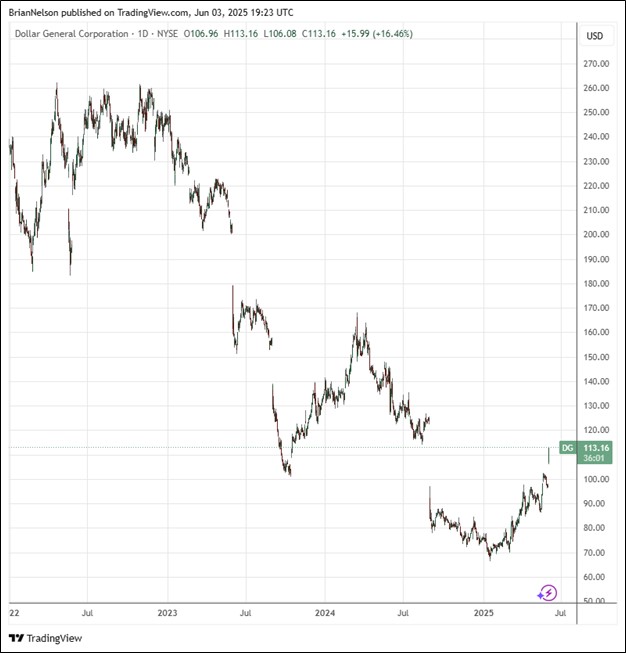

Image: Dollar General’s shares have been under pressure the past few years.

Dollar General updated its fiscal year 2025 guidance to reflect first quarter results and tariff uncertainty. Its updated guidance “assumes the company will be able to mitigate a significant portion of the potential impact to its cost of goods sold from tariffs at currently implemented rates, but that consumer spending could be pressured by tariff-related price increases.” As a result of these moving parts, net sales growth for fiscal 2025 is targeted in the range of 3.7%-4.7%, up from prior expectations of 3.4%-4.4%. Same-store sales growth for the year is targeted at 1.5%-2.5% compared to prior expectations of 1.2%-2.2%. Diluted earnings per share is expected in the range of $5.20-$5.80 compared to its prior expectation in the range of $5.10-$5.80. Shares yield 2.4% at the time of this writing.

-

Dividend Increases/Decreases for the Week of May 30

Dividend Increases/Decreases for the Week of May 30

May 30, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Nvidia Reports Better Than Expected First Quarter Results

Nvidia Reports Better Than Expected First Quarter Results

May 29, 2025

-

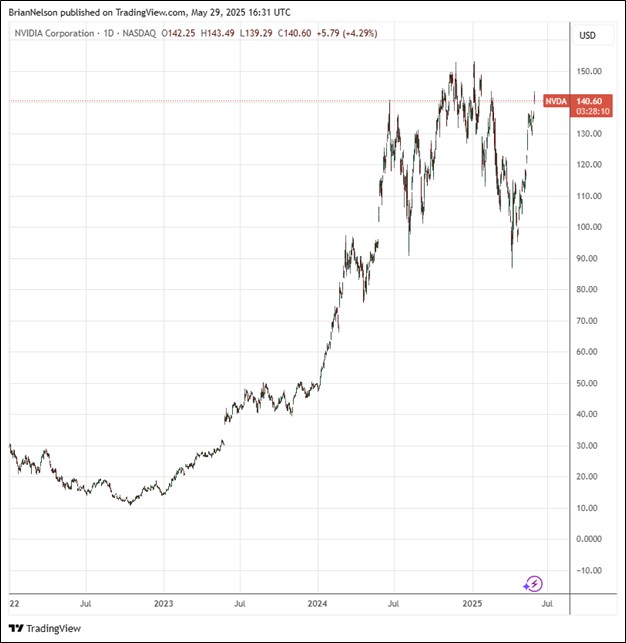

Image: Nvidia’s shares are flirting with all-time highs.

Nvidia ended the quarter with $53.7 billion in cash and marketable securities versus long-term debt of $8.5 billion. Net cash provided by operating activities was $27.4 billion in the first quarter, up from $15.3 billion in the year-ago period. Free cash flow was $26.2 billion in the quarter, up from $15 billion in the year-ago period. Nvidia is a net cash rich, free cash flow generating, secular growth powerhouse, and we continue to like shares in the Best Ideas Newsletter portfolio. Our fair value estimate stands at $163 per share.

-

AT&T Is Targeting $16+ Billion in Free Cash Flow in 2025

AT&T Is Targeting $16+ Billion in Free Cash Flow in 2025

May 28, 2025

-

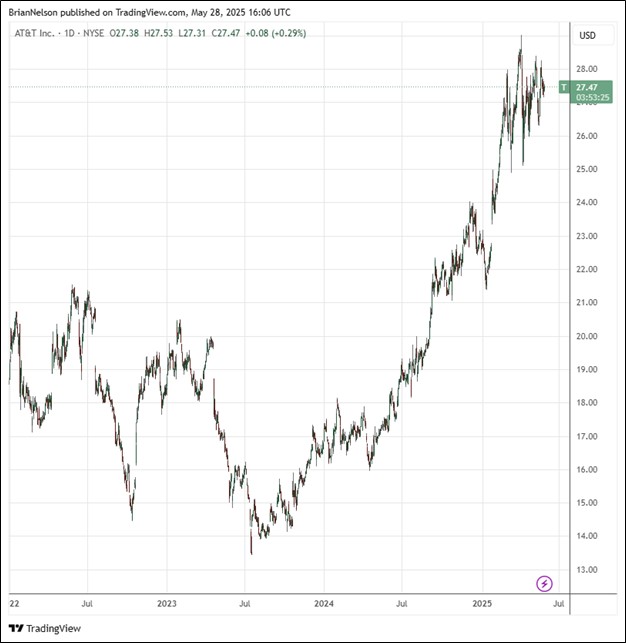

Image: AT&T’s shares have performed well of late.

For its full year 2025 outlook, AT&T expects consolidated service revenue growth in the low-single-digit range, with mobility service revenue growth at the higher end of the 2%-3% range. Adjusted EBITDA is expected to grow 3% or better for the year. Capital investment is targeted in the $22 billion range, while free cash flow is expected to be greater than $16 billion for the year. Adjusted earnings per share for 2025 is targeted in the range of $1.97-$2.07. Net debt was $119.1 billion at the end of the quarter. The high end of our fair value estimate range is $34 per share. Shares yield 4% at the time of this writing.

|