|

|

Recent Articles

-

Realty Income’s Monthly Dividend Is Durable

Realty Income’s Monthly Dividend Is Durable

Jun 21, 2025

-

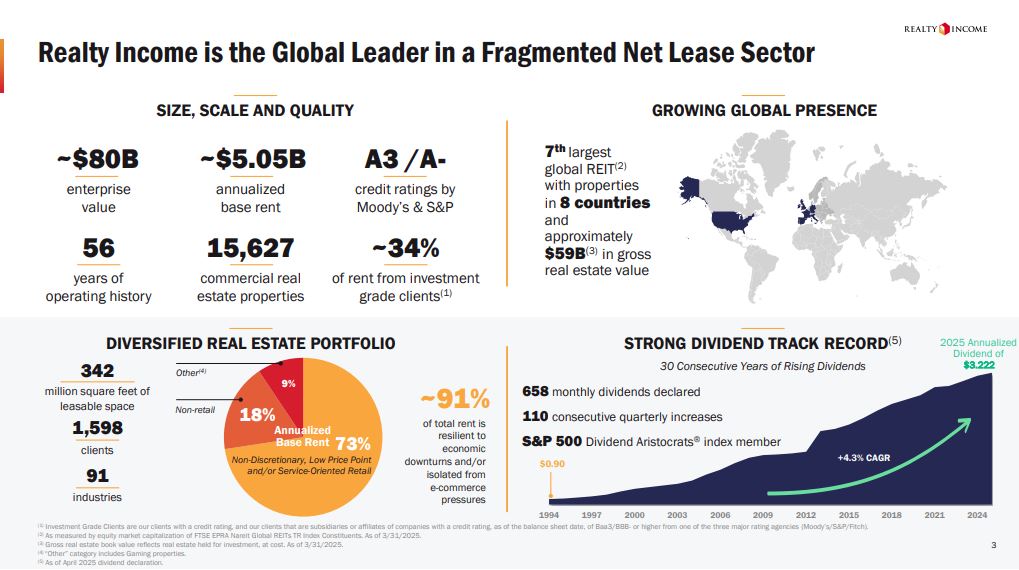

Image Source: Realty Income.

Looking to 2025, Realty Income largely reiterated its prior guidance, with the exception of net income per share being lowered to the range of $1.40-$1.46 from $1.52-$1.58 previously. Adjusted funds from operations was reiterated in the range of $4.22-$4.28 per share for the year with same store rent growth of approximately 1%. Occupancy is targeted at over 98% while investment volume is expected to be approximately $4 billion. We like the durability of Realty Income’s monthly dividend, with shares yielding 5.7% at the time of this writing.

-

Johnson & Johnson Remains an Innovation Powerhouse

Johnson & Johnson Remains an Innovation Powerhouse

Jun 21, 2025

-

Image Source: Johnson & Johnson.

J&J generated free cash flow of ~$3.4 billion in the first quarter compared to $2.85 billion in the year-ago period. Looking to full year 2025 guidance, J&J reiterated its adjusted operational sales growth target in the range of 2%-3%, but it raised its operational sales growth expectations to the range of 3.3%-4.3% from 2.5%-3.5% previously and its estimated reported sales growth guidance to the range of 2.6%-3.6% from 0.5%-1.5% previously. It lowered its adjusted operational earnings per share guidance for the year, but it maintained its adjusted diluted earnings per share guidance in the range of $10.50-$10.70, reflecting 6.2% growth at the midpoint. Shares yield 3.5% at the time of this writing.

-

Dividend Increases/Decreases for the Week of June 20

Dividend Increases/Decreases for the Week of June 20

Jun 20, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Lennar Sees Softness in Housing Market

Lennar Sees Softness in Housing Market

Jun 19, 2025

-

Image Source: TradingView.

On June 16, Lennar Corp. reported mixed fiscal second quarter results with revenue beating the consensus forecast but non-GAAP earnings per share missing the consensus mark. Total revenues fell to $8.4 billion in the quarter from $8.8 billion in the year-ago period, while second quarter net earnings, excluding mark-to-market losses on technology investments were $499 million, or $1.90 per share, compared to $3.38 per share in the same period a year ago.

|