ICYMI -- Video: Exclusive 2020 -- Furthering the Financial Discipline

publication date: Jun 1, 2021

|

author/source: Valuentum Analysts

ICYMI -- Video: Exclusive 2020 -- Furthering the Financial Discipline

---

---

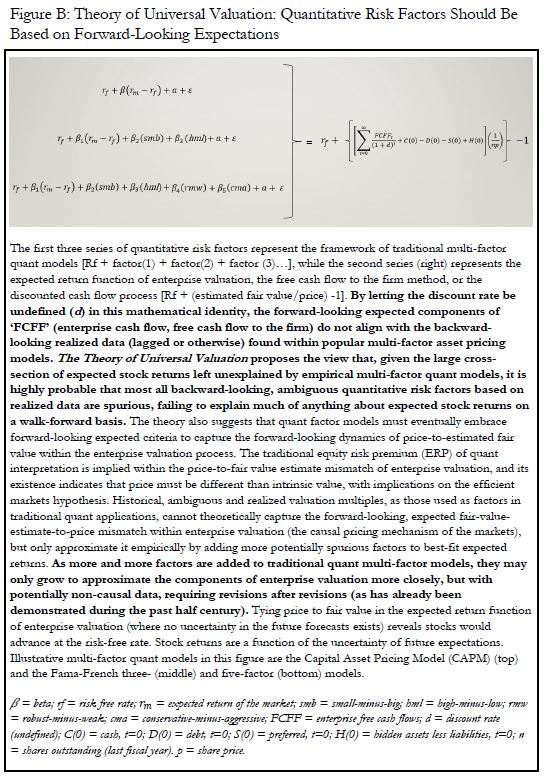

In this 40+ minute video jam-packed with must-watch content, Valuentum's President Brian Nelson talks about the Theory of Universal Valuation and how his work is furthering the financial discipline. Learn the pitfalls of factor investing and modern portfolio theory and how the efficient markets hypothesis holds little substance in the wake of COVID-19. He'll talk about which companies Valuentum likes and why, and which areas he's avoiding. This and more in Valuentum's 2020 Exclusive conference call.

Note: This video was originally published August 2, 2020.

The Theory of Universal Valuation

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

At the time of the original publishing of this video, Brian Nelson owned shares in SPY and SCHG. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment