The Biosimilar Revolution Remains Stymied

We remain intrigued by the potential of the upcoming wave of biosimilar versions of well-established specialty drugs. Even though we have been disappointed by recent FDA decisions, we feel it is inevitable biosimilars will enter the market. Let’s update readers on our thoughts.

By Alexander J. Poulos

Specialty Drug Spending

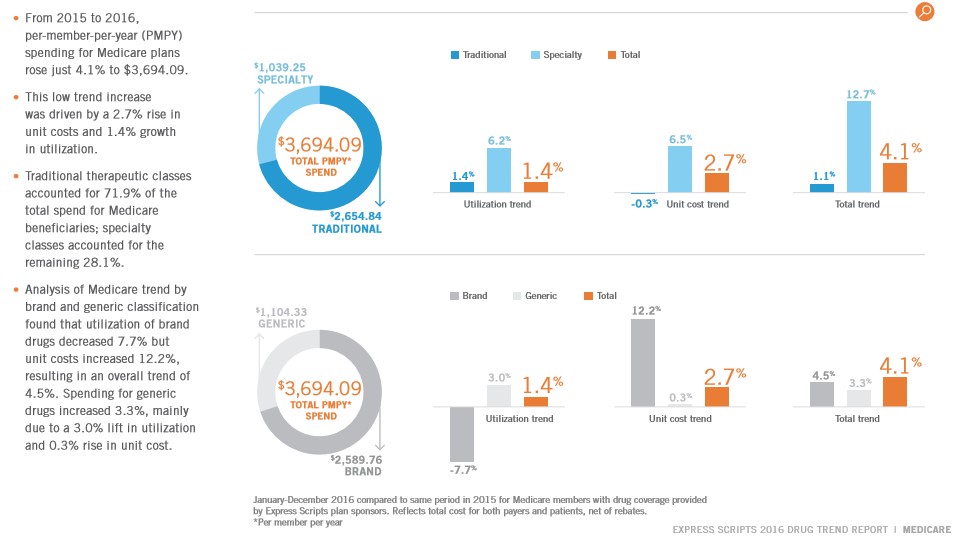

The specialty drug space remains the fastest-growing portion of the overall drug spend in the US. In Medicare plans, however, the total dollars spent grew at a pace on par with inflation. The main reason for the subdued growth is the well-defined process of lower cost generic utilization. The average consumer is well-educated on the cost effectiveness of a generic alternative and shows little resistance to usage when available.

The opposite phenomena are at play in the specialty drug segment, which continues to grow at a pace well above the rate of inflation. Congressional leaders are well aware of the torrid growth in this sector which finally spurred them to action. Congress passed the Biologics Price Competition and Innovation Act of 2009 (BPCI Act). We feel the Act will help drive overall drug spend lower in the coming years, but the initial roll out remains tepid. We are disappointed by the recent string of FDA rejections and wish to highlight a few notable ones.

Coherus BioSciences: A Pure Play on the Coming Biologic Revolution

Coherus Biosciences (CHRS) is an innovative, late-stage biosciences company that focuses on bringing forth biosimilar equivalents of well-established specialty drug products. Coherus is undertaking a two-prong strategy to drive revenue and transform the business into a profitable entity.

The near-term strategy revolves around bringing forth a biosimilar of Amgen’s (AMGN) Neulasta. Amgen continues to rely heavily on older meds such as Neulasta to drive sales. Neulasta remains Amgen’s second-leading product generating annual sales north of $1 billion in 2016. Coherus plans to utilize the profits generated from sales of a biosimilar version of Neulasta to fund the company as it continues the legal assault on the Humira patent estate. As detailed in a recent article, Coherus has achieved some initial success with an invalidation of one of Humira’s patents as mentioned in a recent post, “Coherus Biosciences Begins the Process of Bringing a Humira Biosimilar to Market.”

The equity price of Coherus reacted very favorably to the news, as shares remain volatile. Unfortunately, for Coherus “bulls,” the good news vaporized when the FDA issued a Complete Response Letter delaying the entrance of Coherus version of Neulasta onto the US market. As is typical with smaller biotechs with a limited product line-up, the equity may react negatively to any delay.

Complete Response Letter

In some respects, we have were baffled by the FDA’s move. On one hand, we were pleased to see additional clinical trials are not necessary, but the denial was still issued. The following quote summarizes the issues identified by the FDA.

The CRL primarily focused on the FDA request for a reanalysis of a subset of subject samples with a revised immunogenicity assay, and requests for certain additional manufacturing related process information. The FDA did not request a clinical study to be performed in oncology patients. Additionally, the CRL does not indicate additional process qualification lots would be required or raise concerns over the GMP status of CHS-1701 bulk manufacturing and fill-finish vendors.

A Complete Response Letter (CRL) is issued by the FDA when the agency has decided not to approve the marketing application of a product.

Neulasta Denials Not Confined to Smaller Players

The marketplace remains devoid of a biosimilar version of Neulasta in spite of some notable attempts to bring forth a biosimilar. The problems are not confined to smaller players such as Coherus, as the Sandoz division of pharma heavyweight Novartis (NVS) has also struck out in its attempt. Sandoz received the dreaded CRL in the summer of 2016 and planned to refile in 2018 as it works to address the concerns raised by the FDA.

In addition, Sandoz remains locked in a protracted legal battle with Amgen over the timing of the notice given by Sandoz. The Biologics Price Competition and Innovation Act stipulate the manufacturer of a biosimilar product must give 180-day notice to the company holding the intellectual property rights to the branded product. Sandoz complied with the letter of the law by issuing notice while the product was being reviewed by the FDA. Amgen argued the notice is “too soon” and should be issued after approval.

Under Amgen’s interpretation of the law, it would grant Amgen an additional 180 day of patent protection. A lower court initially sided with Amgen, and the case made its way up to the Supreme Court. The Supreme Court issued a unanimous ruling in favor of Sandoz stating the notice can be given during the FDA review process. We may be witnessing the early stages of the development of a pathway towards bringing forth a biosimilar to market. We anticipate the legal skirmishes will diminish in time as clear rulings and legal precedents are established.

Path Forward for Coherus

The FDA’s denial is a setback that will more-than-likely result in Coherus entering the market to raise additional funds to continue existing research and maintain the legal assault on Abbvie’s (ABBV) patent estate. We are pleased that further trials are not necessary but using Sandoz’s timing as a reasonable backdrop, refiling will be a 2018 event at the earliest, in our view. Of course we cannot confirm the exact timing as management remained coy in the conference call, refusing to place a timetable on the process. We understand the reluctance, but the refusal has created an information vacuum, eroding confidence to a degree.

One of the primary risks involved with late-stage companies such as Coherus is cash burn-- does the company have enough funds to see the research product through and bring the product to market? Coherus holds approximately $175 million in cash and short-term securities on its books as of the end of the first quarter. We estimate the company will need to cut back spending, which may hasten the need to raise additional funds either through a convertible offering, raising additional debt or issuing further shares. The selling of additional shares will dilute current shareholders further--most biotechs resort to this tactic as a last resort.

Concluding Thoughts

Our preferred entities in the healthcare space are the innovators, companies that continue to bring forth great science instead of relying on older products to drive sales (please be sure to view ideas in the newsletter portfolios). We feel the onus going forward will focus on outcomes, at the expense of annual price hikes at a rate well above the rate of inflation. We believe the coming wave of biosimilars will play a crucial role in reducing overall healthcare spending. Still, we remain disappointed the revolution has not caught on as of yet. However, we believe it is a delay in the inevitable, as a wave of biological products will lose patent coverage as the decade progresses. We’re paying close attention.

Healthcare and biotech contributor Alexander J. Poulos is long Novartis.

Related ETFs: IBB, XLV, RHBBY, BIIB, XBI