Member LoginDividend CushionValue Trap |

Fundamental data is updated weekly, as of the prior weekend. Please download the Full Report and Dividend Report for

any changes.

Aug 20, 2020

Johnson & Johnson Buys Momenta Pharmaceuticals

Image Source: Johnson & Johnson – Second Quarter of Fiscal 2020 IR Earnings Presentation. On August 19, Johnson & Johnson announced it was acquiring Momenta Pharmaceuticals for $52.50 per share in cash through a deal worth $6.5 billion (or $6.1 billion when including Momenta Pharmaceuticals’ net cash position). At the end of June 2020, Momenta Pharmaceuticals had ~$0.45 billion in cash and cash equivalents on hand with no debt on the books. We include shares of JNJ as a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Aug 19, 2020

Update: COVID-19 Vaccine Race

Image Source: Johnson & Johnson – Second Quarter of Fiscal 2020 IR Earnings Presentation. The ongoing coronavirus (‘COVID-19’) pandemic has devasted the global economy (though things are starting to improve) and has fundamentally altered daily human life. According to a draft report from the World Health Organization (‘WHO’), there were 29 COVID-19 vaccine candidates undergoing clinical trials as of August 13 along with 138 other candidates undergoing preclinical evaluation. It is a race against the clock. Unfortunately, as of this writing on August 18, there have been ~170,000 COVID-19-related deaths in the US alone according to data from the US Centers for Disease Control and Prevention (‘CDC’). We are optimistic that one of the many “shots on goal” will end up proving successful. The US launched Operation Warp Speed to accelerate the development of a COVID-19 vaccine, which involves providing funding to companies with promising vaccine candidates. Furthermore, please note that major economies around the world have adjusted their rules and procedures to allow for multiple phases of clinical trials to be conducted concurrently. Before getting into some of the most promising COVID-19 vaccine candidates, we hope everyone, their loved ones, and their family members are staying safe out there as we ride out the pandemic. Jul 27, 2020

HCA’s Latest Results Indicate Healthcare Providers Are Holding Up Better Than Expected

Image Source: HCA Healthcare Inc – Second Quarter of 2020 Earnings Press Release. The ongoing coronavirus (‘COVID-19’) pandemic has had a devastating impact on the financial performance of healthcare providers (operators of hospitals and other medical facilities) due to the decline in the number of elective surgeries performed. Please note elective surgeries tend to be more lucrative for healthcare providers than the other services they provide, generally speaking. Elective surgeries in many US states were indefinitely postponed when the pandemic first hit. In late March, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (‘CARES Act’) which included $100 billion in emergency funding for hospitals and healthcare providers to mitigate the financial blow from the pandemic and enable the US healthcare system to continue functioning as best it can under the weight of the pandemic. Jul 21, 2020

Johnson & Johnson Beats Estimates and Raises Guidance

Image Source: Johnson & Johnson – Second Quarter of 2020 IR Earnings Presentation. On July 16, Johnson & Johnson reported second quarter 2020 earnings that beat both consensus top- and bottom-line estimates. Most importantly, Johnson & Johnson increased its full-year guidance for 2020 as the firm is well-prepared to ride out the ongoing coronavirus (‘COVID-19’) pandemic, in our view. We continue to like shares of JNJ in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. As of this writing, shares of JNJ yield ~2.7%. Jun 18, 2020

Recent Events Concerning Johnson & Johnson

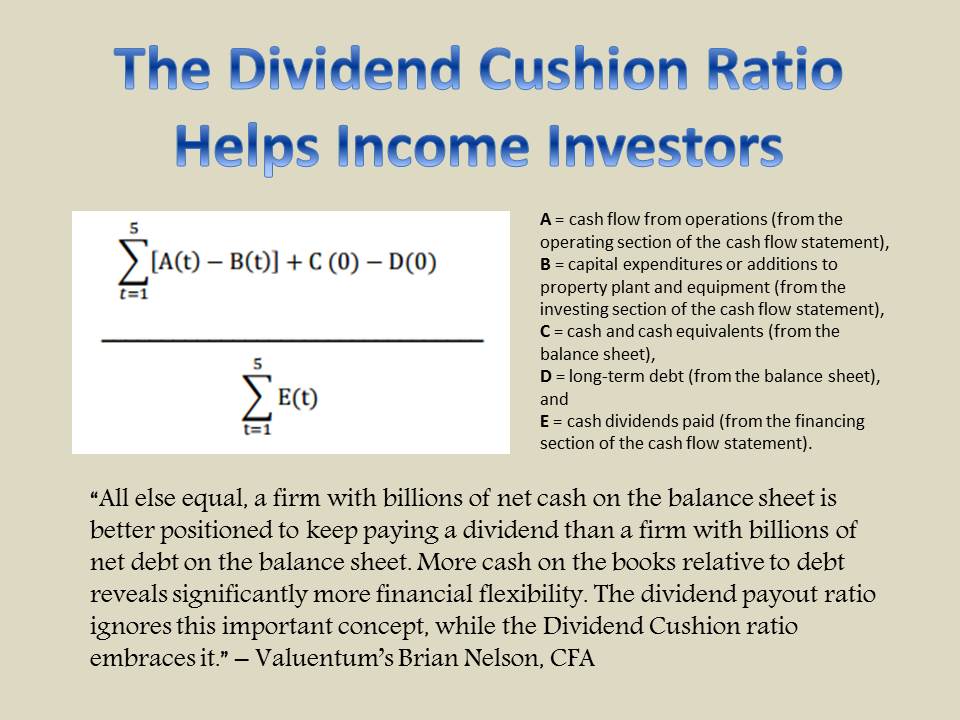

Image Source: Johnson & Johnson – First Quarter of 2020 IR Earnings Presentation. We include Johnson & Johnson as a top-weighted holding in the Dividend Growth Newsletter portfolio and as a medium-weighted holding in the Best Ideas Newsletter portfolio. The firm’s Dividend Cushion ratio sits at a solid 2.1 and please note that this forward-looking dividend coverage ratio factors in our expectations that Johnson & Johnson will grow its per share dividend by mid-single-digits annually over the coming years. Johnson & Johnson earns a “GOOD” Dividend Safety rating and an “EXCELLENT” Dividend Growth rating, with shares of JNJ yielding ~2.8% as of this writing. In our view, Johnson & Johnson’s strong balance sheet and high quality cash flow profile provide it with the financial strength to ride out the storm created by the ongoing coronavirus (‘COVID-19’) pandemic with its current dividend policy and financials intact. May 18, 2020

Excited By COVID-19 Vaccine Candidates

Image Shown: The race is on to find a cure, or better yet a vaccine, for COVID-19. Image Source: Pfizer Inc – First Quarter 2020 Earnings IR Presentation. The race for a COVID-19 cure and vaccine is rapidly evolving with a lot of exciting press releases being put forth. Gilead has taken the lead with a viable treatment, Sorrento is working toward a cure, and it seems most all of big pharma and biotech is racing to find a vaccine, from Johnson & Johnson to Sanofi/GSK and beyond. Though the evaluation of the full data set from a Phase 2 clinical trial means a lot more than the evaluation of a limited set of data from a Phase 1 clinical trial, we think COVID-19 is on the run as modern medicine pushes forward. We’re reiterating our bullish take on the markets today, as we believe that the Fed will do anything and everything to keep this market moving higher, meaning stocks may remain divorced both from economic data and even virus data for some time as they continue to climb. We continue to point to ideas in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio and Exclusive publication. Our top 10 capital appreciation ideas and dividend growth ideas amid COVID-19, respectively, can be found at the following link, “Valuentum's COVID-19 Ideas Have Outperformed Significantly.” As we walk through a ‘who’s who’ as it relates to COVID-19 vaccine candidates, we maintain our view that investors may be facing a “win-win” situation as we outlined in our piece, “Stay Optimistic. Stay Bullish. I Am.” We remain unequivocally bullish on stocks for the long run. May 8, 2020

ICYMI: Never Been More Bullish Even as Buffett Dumps Airlines

Image Source: IATA. Data Source: McKinsey & Company (IATA). Airlines haven’t been able to earn their estimated cost of capital for as long as we can remember. There have been hundreds of airline bankruptcies since deregulation in 1978. The news may be scary in coming months, and market volatility may elevate again, but we’ve never been more bullish on the longer run. The biggest advantage of an individual investor is something called time horizon arbitrage. As many professionals continue to fear a break below the March 23 lows, we’re focused on how this market absorbs the tremendous and unprecedented stimulus in the coming months and what that means for nominal equity prices in the longer run. It may not happen this month or this year, but we expect lift off as investors race to preserve purchasing power! Our favorite ideas for a portfolio setting remain in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, and High Yield Dividend Newsletter portfolio. Our favorite brand new ideas, released each month, are included in the Exclusive publication. Apr 17, 2020

Earnings Roundup for the Week Ended Sunday, April 19, Covering Companies Across the Board

Let's take a look at several earnings reports across numerous industries in this article as the ongoing coronavirus (‘COVID-19’) pandemic forces the global economy to a crawl. Please note that as these reports primarily cover the first quarter of calendar year 2020, the impact of the pandemic has yet to be truly reflected in corporate earnings. That said, these reports still provide an important glimpse into what to expect going forward and how companies are responding to the pandemic. Apr 16, 2020

Johnson & Johnson Beats Estimates, Adjusts Guidance in Light of COVID-19

Image Source: Johnson & Johnson – First Quarter 2020 Earnings IR Presentation. On April 14, Best Ideas Newsletter and Dividend Growth Newsletter portfolio holding Johnson & Johnson increased its quarterly dividend by over 6% sequentially to $1.01 per share which represents the firm’s 58th consecutive annual increase. We view this payout boost in the face of the ongoing coronavirus (‘COVID-19’) pandemic as a sign of management’s confidence in Johnson & Johnson’s future free cash flows, which we appreciate. Shares of JNJ now yield ~2.8% as of this writing at the new annualized payout rate. Mar 22, 2020

Coronavirus disease (COVID-19) -- Sky News

"The crisis gripping the town at the centre of the global COVID-19 crisis in Italy has been witnessed by Sky News' Chief Correspondent Stuart Ramsay." -- Sky News The High Yield Dividend Newsletter, Best Ideas

Newsletter, Dividend Growth Newsletter, Nelson Exclusive publication, and any reports, articles and content found on

this website are for information purposes only and should not be considered a solicitation to buy or sell any

security. The sources of the data used on this website are believed by Valuentum to be reliable, but the data’s

accuracy, completeness or interpretation cannot be guaranteed. Valuentum is not responsible for any errors or

omissions or for results obtained from the use of its newsletters, reports, commentary, or publications and accepts

no liability for how readers may choose to utilize the content. Valuentum is not a money manager, is not a

registered investment advisor and does not offer brokerage or investment banking services. Valuentum, its employees,

and affiliates may have long, short or derivative positions in the stock or stocks mentioned on this site.

|

|||||||||||||||||||||