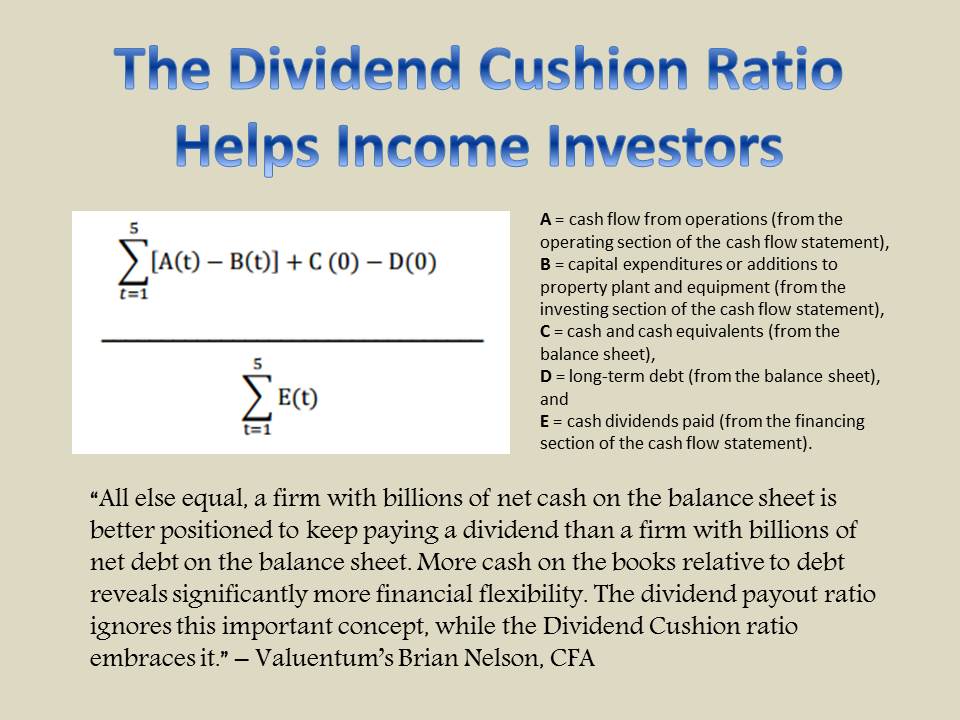

Member LoginDividend CushionValue Trap |

Fundamental data is updated weekly, as of the prior weekend. Please download the Full Report and Dividend Report for

any changes.

Apr 2, 2021

Dividend Increases/Decreases for the Week April 2

Let's take a look at companies that raised/lowered their dividend this week. Mar 31, 2021

Why You Need to Hire an Active Stock Manager and Ditch Modern Portfolio Theory

Image: Why You Need to Hire an Active Stock Manager and Ditch Modern Portfolio Theory. An Approximate Hypothetical representation of an active manager that charges a 2% active management fee that mirrors the S&P 500 benchmark versus an advisor that charges a 1% advisor fee that applies a 60/40 stock/bond rebalancing from 1990-2021. Approximate Hypothetical returns are based on the following extrapolation: “Since inception in November 9, 1992, returns after taxes on distributions and sales of fund shares for the [Vanguard Balanced Index Fund Investor Shares] VBINX came in at 6.5% through June 30, 2020, while the same measure since inception in January 22, 1993, for the S&P 500, as measured by the S&P 500 ETF Trust (SPY), came in at 8.12% through June 30, 2020.” The ‘Approximate Hypothetical 60/40 stock/bond portfolio w/ 1% advisor fee (smoothed)’ represents a hypothetical 100,000 compounded at an annual rate of 5.5% [6.5 less 1] over the period 1990-2021. The ‘Approximate Hypothetical S&P 500 (SPY) w/ 2% active management fee (smoothed)’ represents a hypothetical 100,000 compounded at an annual rate of 6.12% [8.12 less 2] over the period 1990-2021. Approximate Hypothetical results are for illustrative purposes only and are based on the data available. Let's get caught up on recent developments at Korn Ferry, Dick's Sporting Goods, Chewy, GameStop, Williams Sonoma, McCormick & Company, and CRISPR Therapeutics. Mar 29, 2021

Nothing May Derail the U.S. Economy In the Long Run

Image Source: Federal Reserve Bank of St. Louis. U.S. gross domestic product is back on the upswing, and we fully expect the U.S. economy to recover, and then continue its expansion in coming years. U.S. GDP, January 1947 through October 2020. Warren Buffett may have said it best in Berkshire Hathaway’s 2020 Annual Report: “Never bet against America.” Mar 25, 2021

Why You MUST Stay Active in Investing

Image: Active domestic equity mutual funds and ETFs represent just 15% of the stock market, hardly enough data to make any conclusions about the merits of individual stock selection. Source: ICI. I don’t care what kind of indexing propaganda you show me. I’m never playing Russian roulette with my money. I want to know the cash-based intrinsic values of the companies in my portfolio, and that's something worth paying for, regardless of the performance of active versus passive. I care more about what could have happened as a measure of risk than any measure of actual standard deviation. That’s why active management is so valuable. It should help you sleep at night. Mar 24, 2021

Valuentum Wins Bronze at 2021 Axiom Business Book Awards

Value Trap's thought-provoking cry for financial stability wins it a bronze medal at the 14th Annual Axiom Awards. Previous Axiom Business Book Award medalists include Nobel laureate Robert Shiller, former U.S. Secretary of State Condoleezza Rice, and world-renowned historian and Pulitzer Prize winner Doris Kearns Goodwin. Mar 24, 2021

Two Railroad Operators to Join Forces, Creating the First Fully Integrated Canada-US-Mexico Railroad Network

Image Source: Canadian Pacific Railway Ltd, Kansas City Southern – March 2021 Acquisition Presentation. On March 21, Canadian Pacific Railway Ltd announced it was acquiring Kansas City Southern through a cash-and-stock deal worth ~$29.0 billion by enterprise value (factoring in assumed debt). The combination will create the first fully integrated Canada-US-Mexico railroad operator with ~$780 million in annualized synergies expected within three years of the deal closing. Once this two-part transaction is complete, the new entity will have a US Class 1 railroad network that spans ~20,000 miles with ~20,000 employees supporting its operations. The pro forma company will be renamed Canadian Pacific Kansas City (‘CPKC’). Mar 19, 2021

In the News: Facebook Optimistic, Visa Resilient, Dollar General’s Outlook Not Bad and More

The equity markets, as measured by the S&P 500, are trading above/near the high end of our fair value estimate range, but we remain focused on the long run, and there are many individual ideas that present tremendous long-term capital appreciation potential. By far, Facebook is the most undervalued stock on the market, in our view, and recent news has painted its relationship with Apple in a more positive light. The Justice Department is investigating Visa for anti-competitive behavior, but we don’t think its dominant position and lucrative business model will be challenged. Successful vaccines for coronavirus (“COVID-19”) have breathed life into shares of airline equities, but we still don’t view them as long-term investments. Dollar General will see its yearly streak of consecutive same-store sales growth come to an end in fiscal 2021 (ends January 28, 2022), but we’re still positive on the name. Some of our best ideas continue to be in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. For investors seeking higher-yielding ideas, please consider the High Yield Dividend Newsletter publication. Mar 16, 2021

Honeywell Reaffirms Outlook, Dividend Looks Great

Image Source: Honeywell – J.P. Morgan Industrials Conference Presentation. 2021 will be a solid year for Honeywell, but we expect 2022 and 2023 to be even brighter, as some of the company’s revenue initiatives bear fruit in a much healthier industrial marketplace buoyed by greater infrastructure spending. The cost cuts put in place during COVID-19 should help with margin improvement as economic conditions pick up, putting the firm in a position to surprise to the upside. We expect continued dividend growth. Honeywell yields 1.7% at the time of this writing. Feb 23, 2021

Innovative Fuel Cell Company Ceres Power Has a Stellar Growth Outlook

Image Source: Ceres Power Holdings plc – Interim 2020 Results IR Presentation. UK-based Ceres Power is a pioneer in the fuel cell industry, with its SteelCell technology leading the way. The company has historically been unprofitable, though it aims to create a sizable high-margin licensing business over the coming years. Ceres Power is working with its strategic partners on pilot projects that aim to prove the viability of its technology. This past December, Bosch, one of Ceres Power’s strategic partners and largest shareholders, announced that starting in 2024, it would commence commercial-level production of fuel cells utilizing Ceres Power’s technology. Shares of Ceres Power are on a powerful upward trend of late as its cash flow growth trajectory is now quite promising. The firm’s net cash position (at the end of June 2020) will help the company cover its cash flow outspend as Ceres Power scales up its licensing business while continuing to make major R&D investments. Current and future support from national governments worldwide underpins the promising outlook for the fuel cell industry. Capital appreciation seeking investors should keep Ceres Power on their radar.

prev12345678910111213141516171819202122232425

26272829303132333435363738394041424344454647484950 51525354555657585960616263646566676869707172737475 767778798081828384858687888990919293949596979899100 101102103104105106107108109110111112113114115116117118119120 121122123124125126127128129130next The High Yield Dividend Newsletter, Best Ideas

Newsletter, Dividend Growth Newsletter, Nelson Exclusive publication, and any reports, articles and content found on

this website are for information purposes only and should not be considered a solicitation to buy or sell any

security. The sources of the data used on this website are believed by Valuentum to be reliable, but the data’s

accuracy, completeness or interpretation cannot be guaranteed. Valuentum is not responsible for any errors or

omissions or for results obtained from the use of its newsletters, reports, commentary, or publications and accepts

no liability for how readers may choose to utilize the content. Valuentum is not a money manager, is not a

registered investment advisor and does not offer brokerage or investment banking services. Valuentum, its employees,

and affiliates may have long, short or derivative positions in the stock or stocks mentioned on this site.

|

|||||||||||||||||||||

The wind is at our backs. The Federal Reserve, Treasury, and regulatory bodies of the U.S. may have no choice but to keep U.S. markets moving higher. The likelihood of the S&P 500 reaching 2,000 ever again seems remote, and I would not be surprised to see 5,000 on the S&P 500 before we see 2,500-3,000, if the latter may be in the cards. The S&P 500 is trading at ~4,100 at the time of this writing. The high end of our fair value range on the S&P 500 remains just shy of 4,000, but I foresee a massive shift in long-term capital out of traditional bonds into equities this decade (and markets to remain overpriced for some time). Bond yields are paltry and will likely stay that way for some time, requiring advisors to rethink their asset mixes. The stock market looks to be the place to be long term, as it has always been. With all the tools at the disposal of government officials, economic collapse (as in the Great Depression) may no longer be even a minor probability in the decades to come--unlike in the past with the capitalistic mindset that governed the Federal Reserve before the “Lehman collapse."