Member LoginDividend CushionValue Trap |

Fundamental data is updated weekly, as of the prior weekend. Please download the Full Report and Dividend Report for

any changes.

May 8, 2020

ICYMI: Never Been More Bullish Even as Buffett Dumps Airlines

Image Source: IATA. Data Source: McKinsey & Company (IATA). Airlines haven’t been able to earn their estimated cost of capital for as long as we can remember. There have been hundreds of airline bankruptcies since deregulation in 1978. The news may be scary in coming months, and market volatility may elevate again, but we’ve never been more bullish on the longer run. The biggest advantage of an individual investor is something called time horizon arbitrage. As many professionals continue to fear a break below the March 23 lows, we’re focused on how this market absorbs the tremendous and unprecedented stimulus in the coming months and what that means for nominal equity prices in the longer run. It may not happen this month or this year, but we expect lift off as investors race to preserve purchasing power! Our favorite ideas for a portfolio setting remain in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, and High Yield Dividend Newsletter portfolio. Our favorite brand new ideas, released each month, are included in the Exclusive publication. May 6, 2020

Berkshire Hathaway Prepares Itself for COVID-19

Image Source: Berkshire Hathaway Inc – 2019 Annual Report. Berkshire Hathaway reported first-quarter 2020 earnings on May 2, which due to significant unrealized losses in its investment portfolio (a product of the market swoon in the early months of 2020) the firm swung to a large loss on a GAAP basis. As Berkshire Hathaway’s leadership team has often noted, the 2018 accounting rule change that forces companies to recognize unrealized gains and losses in the income statement can make GAAP net income and GAAP diluted EPS figures near meaningless without digging deeper into the firm’s financials. Apr 8, 2020

US Fiscal Stimulus and Emergency Spending Update

Image Source: Pictures of Money. On Thursday, April 9, the US Senate is set to hold a vote on whether to add additional funding towards helping small- and medium-sized businesses (‘SMBs’) on top of the $350 billion allocated towards a loan/grant program that was included in the recently passed $2+ trillion Coronavirus Aid, Relief, and Economic Security Act (‘CARES Act’). Key Republican legislators and Trump administration officials including Senate Majority Leader McConnell (Kentucky), Treasury Secretary Mnuchin, and Senator Rubio (Florida) who is Chairman of the Senate Committee on Small Business and Entrepreneurship, want to add $250 billion in funding capacity to the SMBs relief program, dubbed the Paycheck Protection Program (‘PPP’). That program involves providing loans to SMBs equal to 250% of their monthly payroll, and those loans can be used to pay employees along with utilities and rent. If those funds are used to retain workers, they can become forgivable loans and effectively grants (if certain conditions are met). Mar 26, 2020

US Congress Is Getting Ready to Pass a Massive ~$2.2 Trillion Fiscal Stimulus Bill

Image Shown: US equities have started to recover some of their lost ground as the likelihood that the US Congress will pass a massive ~$2.2 trillion fiscal stimulus and emergency spending package, dubbed the CARES Act, has increased significantly over the past week as seen through the bounce in the SPDR S&P 500 ETF Trust. President Trump has clearly indicated that he intends to sign such a bill into law as soon as possible, with the US House of Representatives expected to take up the legislation this upcoming Friday morning on March 27. On March 25, the US Senate worked late into the night to secure a bipartisan compromise on a massive ~$2.2 trillion fiscal stimulus and emergency spending bill to offset the negative impact of the ongoing novel coronavirus (‘COVID-19’) pandemic. The bill passed 96-0 after several senators forced a vote on an amendment on that bill that would have changed the nature of the “beefed up” unemployment benefits (that amendment failed 48-48, and would have needed 60 votes to pass). As of this writing, there are over 65,000 confirmed cases of COVID-19 in the US according to Johns Hopkins University, and we sincerely hope everyone, their families, and their loved ones stay safe during this pandemic. A vote in the US House of Representatives is expected this upcoming Friday morning on March 27. The House is expected to convene at 9AM EST and the goal of each party’s leadership is to secure passage of the bill via a voice vote (please note that this differs from unanimous consent, which requires every member of the House to agree to such a legislative process in order to pass a bill without having the majority of lawmakers return to Washington DC, but this is easier/faster to achieve than a recorded roll call vote that would force every member of the House to return). Assuming the House swiftly passes the bill that was approved in the Senate, President Trump has clearly communicated he would sign the bill into law right away. Please note this bill is formally known as the Coronavirus Aid, Relief, and Economic Security (‘CARES’) Act. Mar 23, 2020

US Fiscal Stimulus Update

Image Source: frankieleon. The US Congress is debating and working on a massive multi-trillion dollar fiscal stimulus package to mitigate the negative impact the ongoing novel coronavirus (‘COVID-19’) pandemic is having on the domestic economy and to provide for additional healthcare funds to cash-strapped entities to combat the virus. Mar 19, 2020

Extreme Volatility and Crisis Economics

Image: The Dow Jones has now registered 8 consecutive trading days with a 4% move in either direction, from March 9 through March 18. This is the most volatile time in history, a streak that is longer than the 5 consecutive days registered in November 1929 (Great Depression), 4 consecutive days in 1987 (Crash of 1987), and 4 consecutive days in 2008 (Great Financial Crisis). The worst of the declines may still be ahead of us. The S&P 500 still is trading within our fair value estimate range of 2,350-2,750, and we wouldn’t be surprised to see panic/forced selling all the way down to 2,000 on the S&P. Expect more volatility, and please stay safe out there as the world declares all out war on COVID-19. Our best ideas remain in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio, and Exclusive publication. Mar 18, 2020

Banking Entities: The Technicals Tell the Story

Image: The Financial Select Sector SPDR ETF has experienced a tremendous amount of pain in recent weeks. What is clear is that temporarily shutting down large parts of U.S. economy is absolutely unprecedented, and there will be substantial knock-on effects and difficulties in getting things restarted. This is most especially true if the coronavirus re-emerges following the periods of social distancing around the world, or when the weather turns colder again in the fall, and humanity could be facing a different strand of the coronavirus. Don’t forget that all bank institutions use a lot of financial leverage by their very nature, and the Fed and Treasury can never truly stop a run-on-the-bank dynamic (i.e. that which happened to WaMu in 2008). We think BOK Financial is in particular trouble given its energy loan exposure. Others to avoid include Cullen/Frost Bankers, Cadence Bancorp, and CIT Group. The credit card entities, Capital One and Synchrony Financial may be worth avoiding. We’d stay far away from the regional banks given their exposure to small business pain amid COVID-19. We don’t think the fiscal stimulus on the table does much to help small businesses. Deutsche Bank may be the first of the big European banks to topple, and this weakness could eventually spread to the U.S. banks given counterparty risk. Most foreign banks, including Santander, Credit Suisse, UBS, ING, and BBVA remain exposed to crisis scenarios. We’re also witnessing some very troubling developments with banking preferred shares, with the bank-preferred-heavy ETF, Global X SuperIncome Preferred ETF dropping ~15% during the trading session March 18. The preferreds of HSBC and Ally Financial are top weightings in that ETF. Banking technicals are raising some major red flags across the board, and given actions by the Fed and Treasury, this crisis has all the makings of being worse than the Great Financial Crisis. In any financial crisis perhaps excepting a depression, there can come a time to invest new money in bank stocks. Though it seems likely we have not yet reached the bottom in the markets yet, the highest-ground bank franchises in the US are JPMorgan and Bank of America, in our view. While sharp declines in their equity values may be expected (no one truly knows how deep the coming flood will be), they’re likely to make it to the other side with most of their equity capital firmly intact. With all that said, however, one doesn’t have to hold banking equities. It may be time to phone Mr. Buffett before things really start to unfold. Mar 18, 2020

US Considering $1 Trillion (Or More) Fiscal Stimulus Program

Image Source: Frank Boston. A lot has changed in a short period of time since we published our first note covering the potential for a major US fiscal stimulus program back on March 10. Due to the sheer amount of pummeling the stock and credit markets have taken over the past few weeks, along with consumer, business, and investor confidence at-large (we’ll get a better read on that over time), it seems that both Democrats and Republicans are now more open to a major fiscal stimulus program than before. The ‘Survey of Consumers’ conducted by the University of Michigan notes the ‘Index of Consumer Sentiment’ fell from 101.0 in February 2020 down to 95.9 in March 2020, and there’s room for that index to fall a lot further. Please note the next data release date is March 27. In all likelihood, this is all due to the negative impacts posed by the ongoing novel coronavirus (‘COVID-19’) pandemic to both the health of individuals (particularly the older demographics and those with preexisting conditions) and the health of the overall economy (due to the “cocooning” of households and consumers). We sincerely hope everyone, their loved ones, and their families stay safe out there as we get through this pandemic as a nation and as a global community. Mar 17, 2020

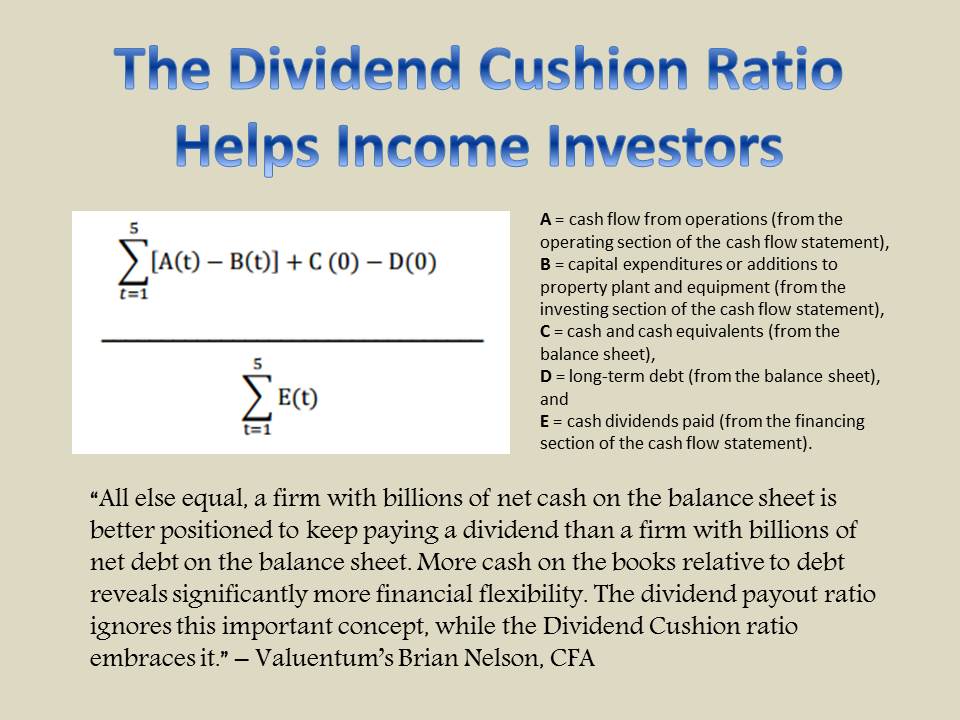

Buybacks and Wealth Destruction

From Value Trap: "According to S&P Dow Jones Indices, S&P 500 stock buybacks alone totaled $519.4 billion in 2017, $536.4 billion in 2016, and $572.2 billion in 2015. In 2018, announced buybacks hit $1.1 trillion. Given all the global wealth that has been accumulated through the 21st century, it may seem hard to believe that another Great Depression is even possible. However, in the event of a structural shock to the marketplace where aggregate enterprise values for companies are fundamentally reset lower, the vast amount of cash spent on buybacks would only make matters worse. The money that had been spent on buybacks could have been distributed to shareholders in the form of a dividend or even held on the books as a sanctuary of value within the enterprise during hardship. Buybacks, unlike dividends, can result in wealth destruction in a market economy, much like they can with companies. This is an important downside scenario that is often overlooked." -- Value Trap, published 2018 The High Yield Dividend Newsletter, Best Ideas

Newsletter, Dividend Growth Newsletter, Nelson Exclusive publication, and any reports, articles and content found on

this website are for information purposes only and should not be considered a solicitation to buy or sell any

security. The sources of the data used on this website are believed by Valuentum to be reliable, but the data’s

accuracy, completeness or interpretation cannot be guaranteed. Valuentum is not responsible for any errors or

omissions or for results obtained from the use of its newsletters, reports, commentary, or publications and accepts

no liability for how readers may choose to utilize the content. Valuentum is not a money manager, is not a

registered investment advisor and does not offer brokerage or investment banking services. Valuentum, its employees,

and affiliates may have long, short or derivative positions in the stock or stocks mentioned on this site.

|

Image Source: Daniel Lobo. In this piece, we examine where the economy and stock markets have been recently, where we are now, and where we are going next. We also highlight four key ways to play this volatile market. We think this is a helpful way to think about overall portfolio construction, especially so that one does not overly expose themselves to a particular set of risks that could come to fruition—like an extended downturn in the economy or a rapid discovery of a vaccine for Covid-19 on the other hand.